Excise tax calculator

A tax credit in the amount of 050 per gallon is available for the following alternative fuels. Payments are due semimonthly.

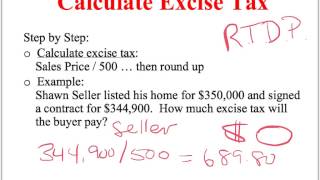

Calculating Excise Tax Help With Closing Statments Youtube

Tax collection and Narcotics suppression.

. This allows you to collect the full amount of excise tax due. Colorado has a 29 statewide sales tax rate but also has 279 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4091 on top of the state tax. A tax incentive is available for alternative fuel that is sold for use or used as a fuel to operate a motor vehicle.

After the cars first year for cars with a list price below 40000 the road tax costs are change. For all cars with a CO2 rating of zero the tax bill is zero and for all cars above 255gkm youll pay an additional 135 for an alternatively-fuelled car and an additional 145 for petrol and diesel-powered cars. This means that depending on your location within Florida the total tax you pay can be significantly higher than the 6 state sales tax.

Excise Taxation and Narcotics Control Department Government of Sindh Introduction. Natural gas liquefied hydrogen propane P-Series fuel liquid fuel derived from coal through the Fischer-Tropsch process and. Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1036 on top of the state tax.

This means that depending on your location within Colorado the total tax you pay can be significantly higher than the 29 state sales tax. IRS Form 720 the Quarterly Federal Excise Tax Return is a tax form businesses complete to report and pay federal excise tax. Contractors Excise Tax Bid Factor Calculator.

The Excise Taxation Department is the main revenue collecting agency of the Government of Sindh which plays a paramount role in resource mobilization. You can also input a custom scenario. Because contractors excise tax is owed on your gross receipts which include any taxes collected from the customer a bid factor of 2041 may be used to calculate the excise tax when preparing a bid or bill.

The Department has been entrusted with two functions ie. Weve created a tax calculator that helps demonstrate how the Tax Cuts and Jobs Act TCJA and other major tax reform proposals could affect taxpayers in different scenarios. The calculator allows you to compare how different sample taxpayers fare under different proposals.

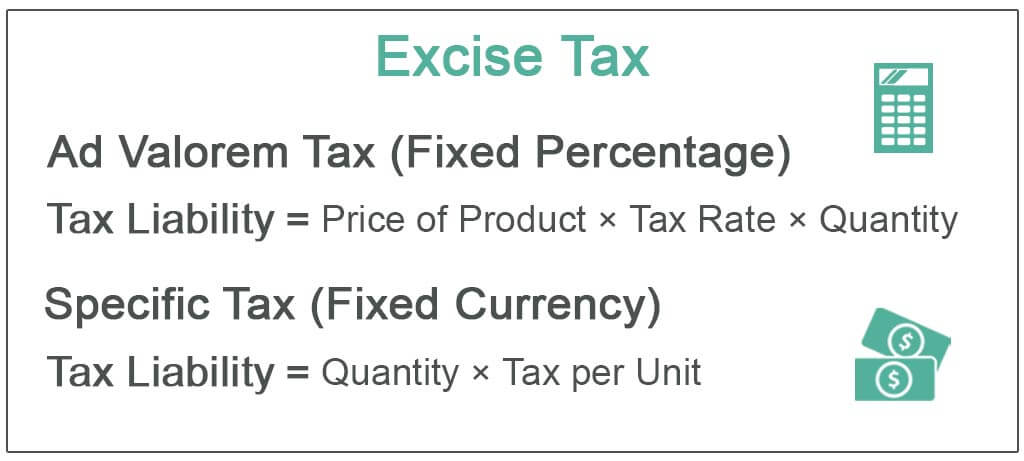

Excise Tax Definition Types Calculation Examples

Use This Free Calculator To Estimate Canadian Cannabis Excise Tax

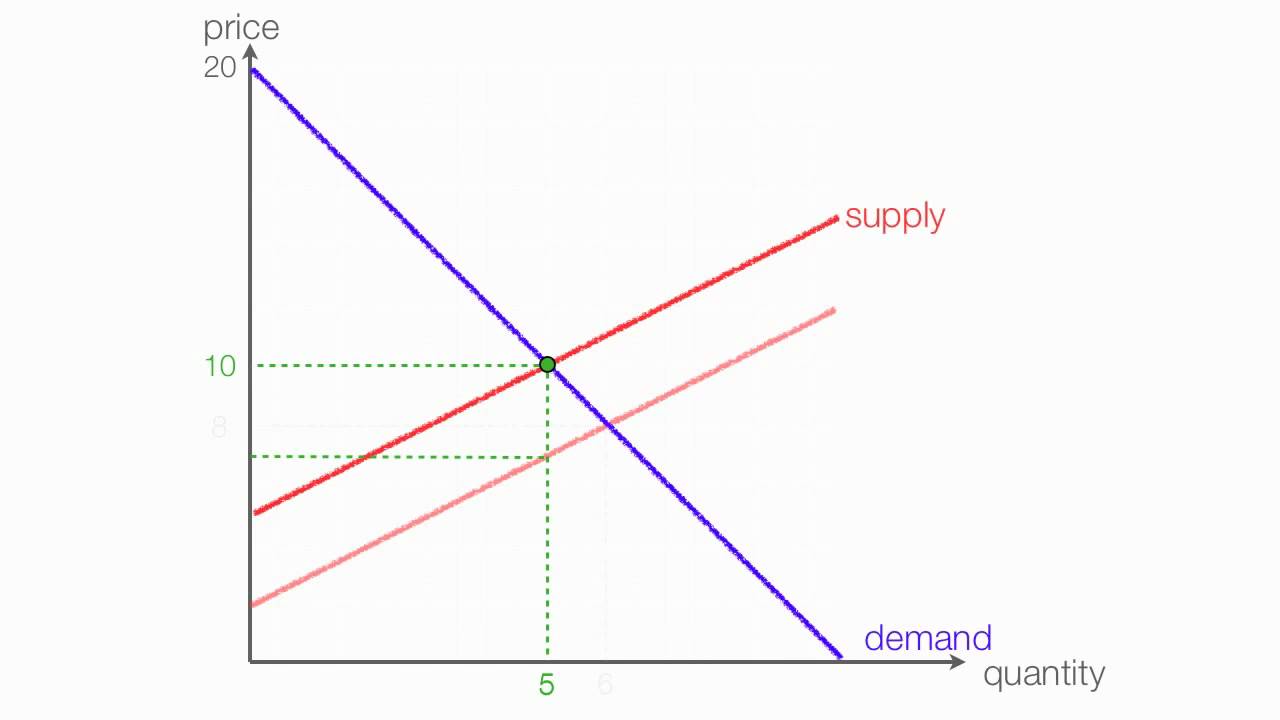

Microeconomics Excise Tax Effect On Equilibrium Youtube

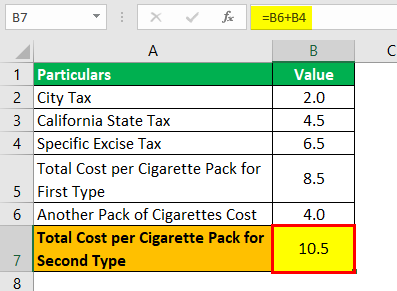

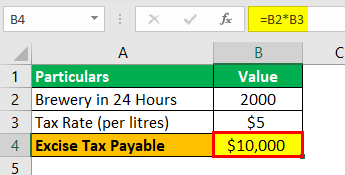

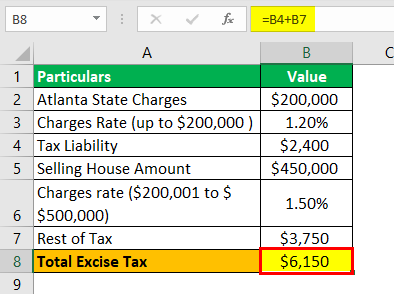

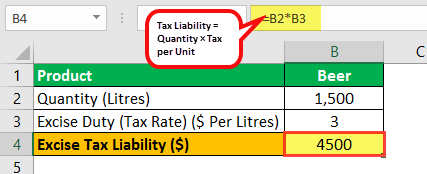

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Excise Tax What It Is How It S Calculated

Cannabis Excise Duties In Canada Global Cannabis Compliance Blog

Calculating Excise Tax Help With Closing Statments Youtube

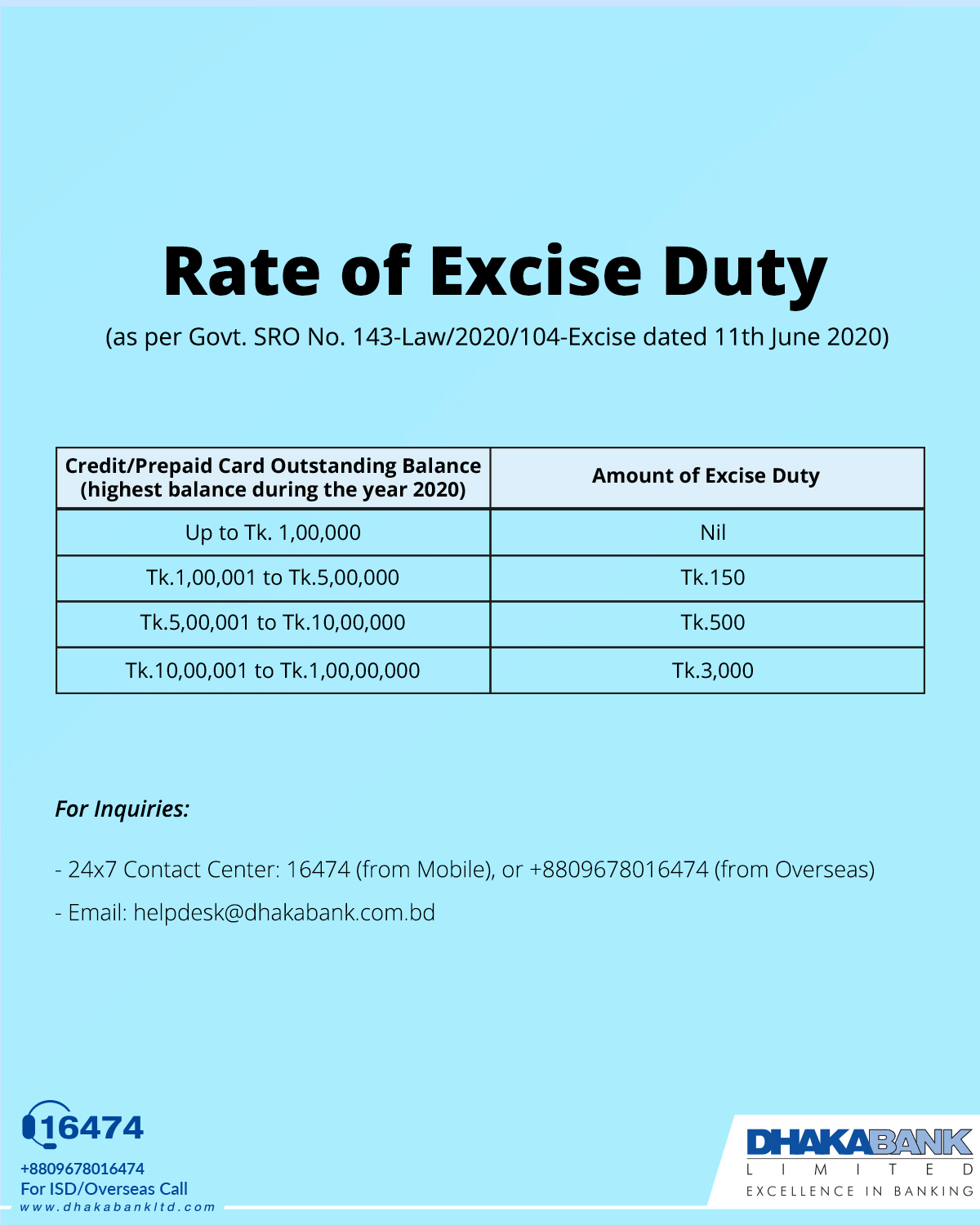

Rate Of Excise Duty Dhaka Bank Excellence In Banking

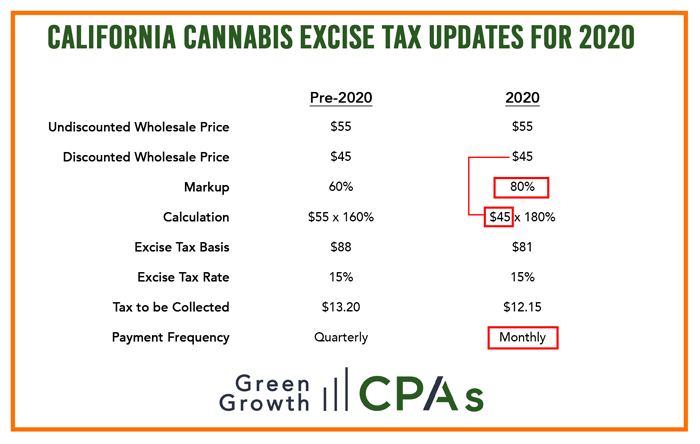

Cannabis Excise Tax Calculation Updates For 2020 Greengrowth Cpas

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

How To Calculate Excise Tax And The Impact On Consumer And Producer Surplus Youtube

How To Calculate Cannabis Taxes At Your Dispensary

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Excise Tax Definition Types Calculation Examples

Excise Tax Definition Types Calculation Examples

Use Our Fuel Calculator To Estimate Your Fuel Excise Tax Refund

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations