Mortgage calculator adding extra principal

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Found on the Set Dates or XPmts tab.

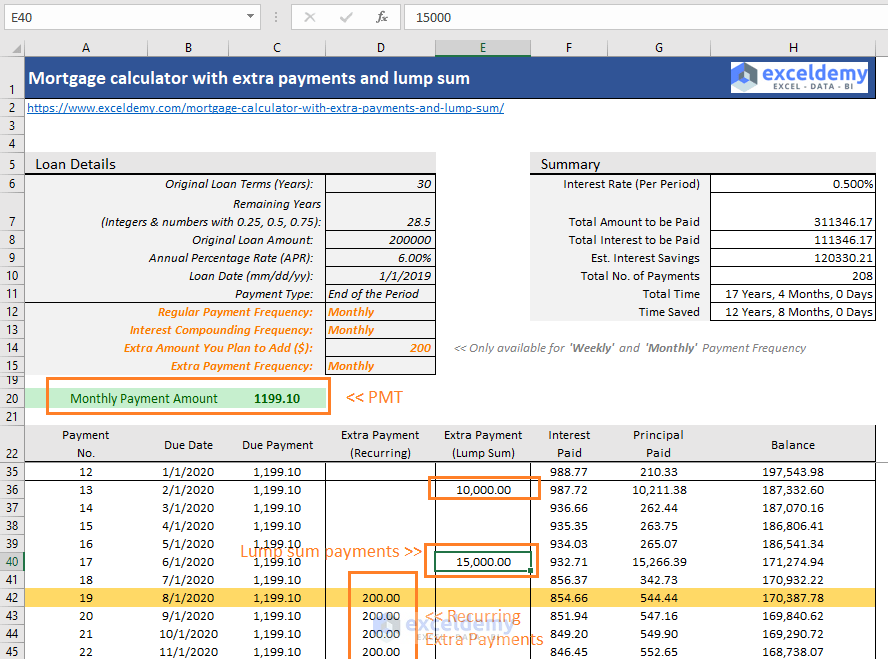

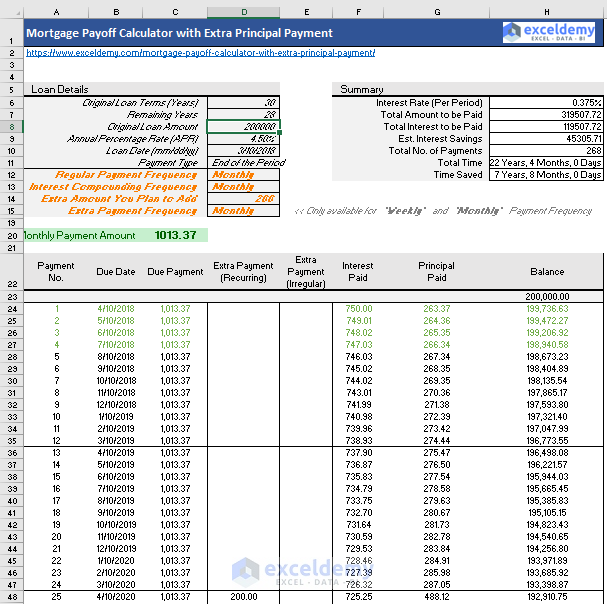

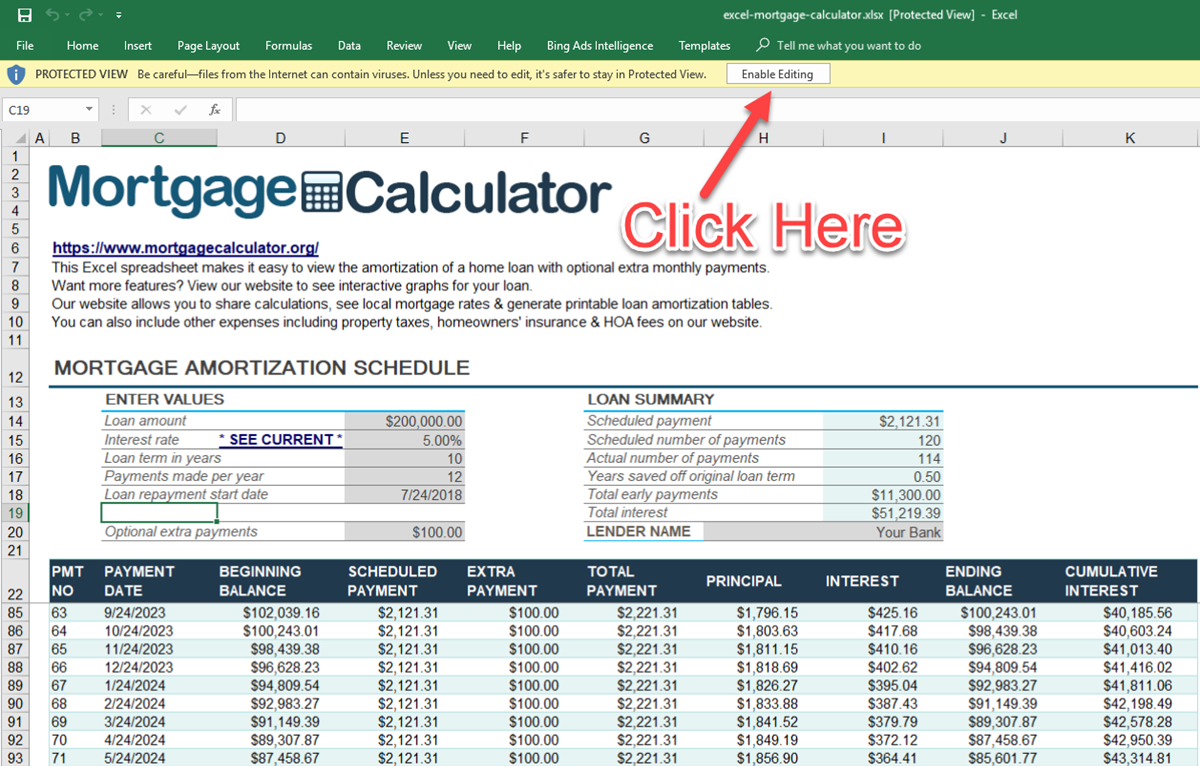

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Both calculations presume the interest rate remains at 3 APR.

. Of course thats just a ballpark estimate. For a 240000 loan 1 point would be 2400. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. In the example above after one year of additional payments the principal amount would increase to 13700. If you found a home but needed handi-capable access added to move in the 203k is a smart and simple option.

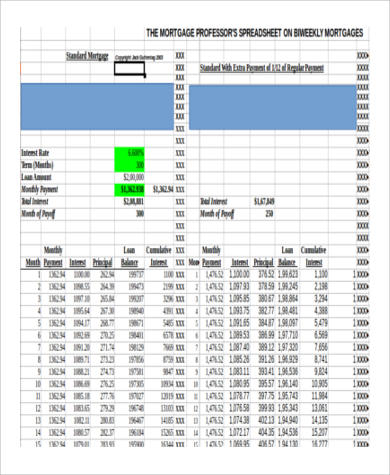

Compound Interest refers to earning or paying interest on interestAlthough it can apply to both savings and loans it is easiest to understand when thinking about savings. If you made regular monthly payments for a period of time before switching to biweekly payments andor want to add extra funding to the payments please use the advanced calculators here. How Do Biweekly Mortgage Payments Work.

The amount of interest that you pay will depend on your principal balance. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance. Typically 1 point is equivalent to 1 of the loans principal.

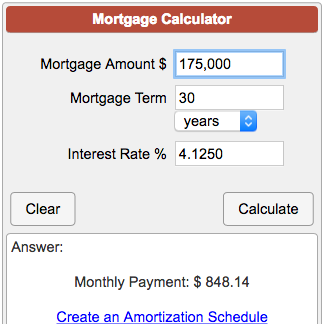

This is the best option if you are in a rush andor only plan on using the calculator today. Enter the term of the mortgage in the number of years. Making extra mortgage payments are a.

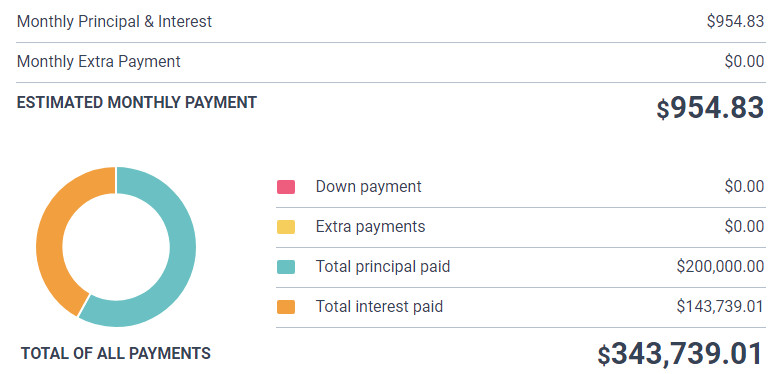

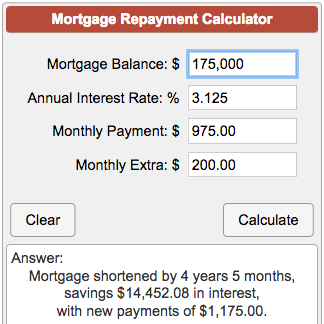

Use our calculator to estimate your monthly mortgage payment including principal interest property taxes homeowners insurance and even private mortgage insurance if its required. Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. Enter the annual interest rate of the mortgage.

If this is for an existing mortgage enter the number of mortgage payments you have already made. Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs. If youre curious about the benefits of adding an additional principal amount to your monthly payment we encourage you to explore your possibilities with our Extra Monthly.

See how those payments break down over your loan term with our amortization calculator. See the table below. Points can be paid upfront by the home buyer andor seller.

So if youre currently paying 1000 per month in principal and interest payments youd have to pay roughly 1500 per month to cut your loan term in half. Mortgage Closing Date - also called the loan origination date or start date. Lets say you have a 220000 30-year mortgage with a 4 interest rate.

The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months. What is a lump sum mortgage payment. Whatever extra you pay today is extinguished debt not accruing any further.

The total interest savings will amount to 12438. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Enter either the original or the new mortgage principal amount borrowed.

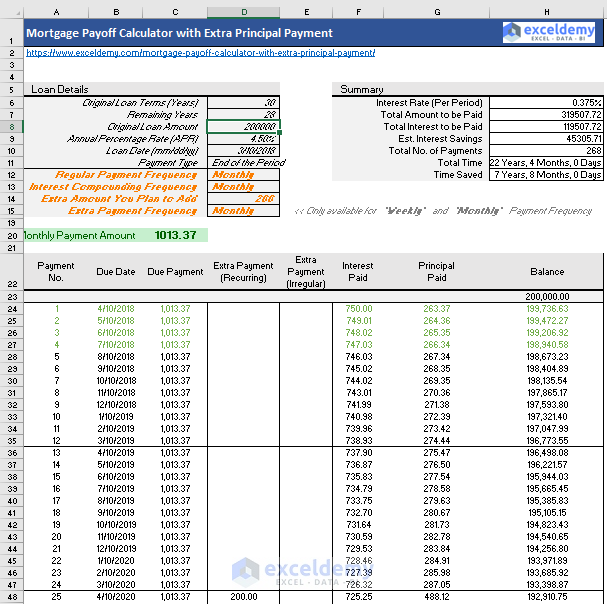

As you make mortgage payments your principal balance will decrease. Use Vanderbilt Mortgages Extra Monthly Principal Calculator to calculate your potential monthly loan payments change in number of payments and interest savings. A borrower continues to match the principal amount with an additional payment.

Your mortgage principal balance is the amount that you still owe and will need to pay back. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. 30-Year Fixed Mortgage Principal Loan Amount.

A title for these calculator results that will help you identify it if you have printed out several versions of the calculator. Adding 200 on your bi-weekly mortgage payments shortens your term by 7 years. A lump sum mortgage payment is a one-time payment that you can put down on your mortgage when you have extra funds.

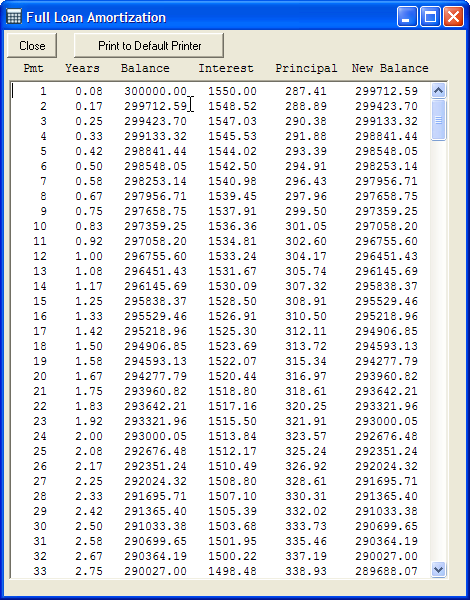

About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency. Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. The mortgage amortization schedule shows how much in principal and interest is paid over time.

If you loved a home but needed an extra bedroom added the 203k rolls the cost of adding one into a single payment. But also very powerful. In some cases your lender might not offer a bi-weekly payment schedule.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals. Your mortgage can require.

They can also be rolled into the loans principal. Home buyers can shave years off their loan by paying bi-weekly making extra payments. Field Help Input Fields.

This calculator presumes one starts making biweekly payments at the onset of the mortgage. Depending on your mortgage some will let you do a lump sum payment. Consider how long you plan on living in the home.

However as the loan progresses the ratio of interest and principal inverts so that eventually the principal represents the majority of the payment. This is the best option if you plan on using the calculator many times over the. This means that when you get a mortgage and borrow 400000 your mortgage principal will be 400000.

Bi-weekly payments help you pay off principal in an accelerated fashion before interest has a chance to compound on it. What if I cant arrange bi-weekly payments. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching.

First Payment Due - due date for the first payment. Why Early Extra Payments Matter. Adjust the home price loan term down payment and interest rate to find the right mortgage fit for your budget.

If a home needed significant landscaping before it would fully appeal to you it is something the 203k can help with. You may think 50 or 100 a month is a small sum but no amount is too small. Additional mortgage payments have the biggest impact during the first years of the loan.

On a fixed-rate mortgage the upfront points payment guarantees the lower rate of interest for the life of the loan. Meanwhile with extra 100 per month you can remove 3 years and 4 months from the loan term. This is because the principal or outstanding balance is larger.

Four alternatives to paying extra mortgage principal. In the early years of a longterm loan most of the payment is applied toward interest. The loan is secured on the borrowers property through a process.

Building a Safety Buffer by Making Extra Payments. Noun a single payment made at a particular time as opposed to a number of smaller payments or installments. 100 per month.

After each compound period the interest earned over that period is added to the principal so that the next calculation of interest includes the original principal plus the previously earned interest.

Free Interest Only Loan Calculator For Excel

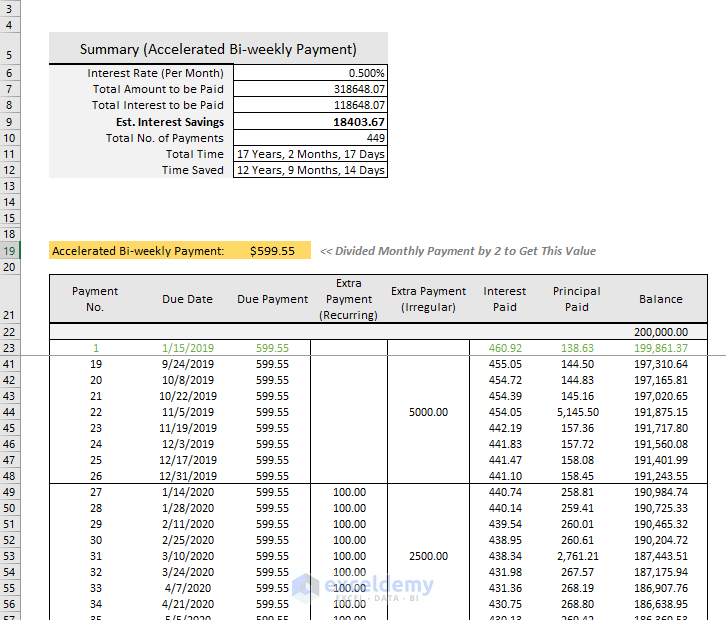

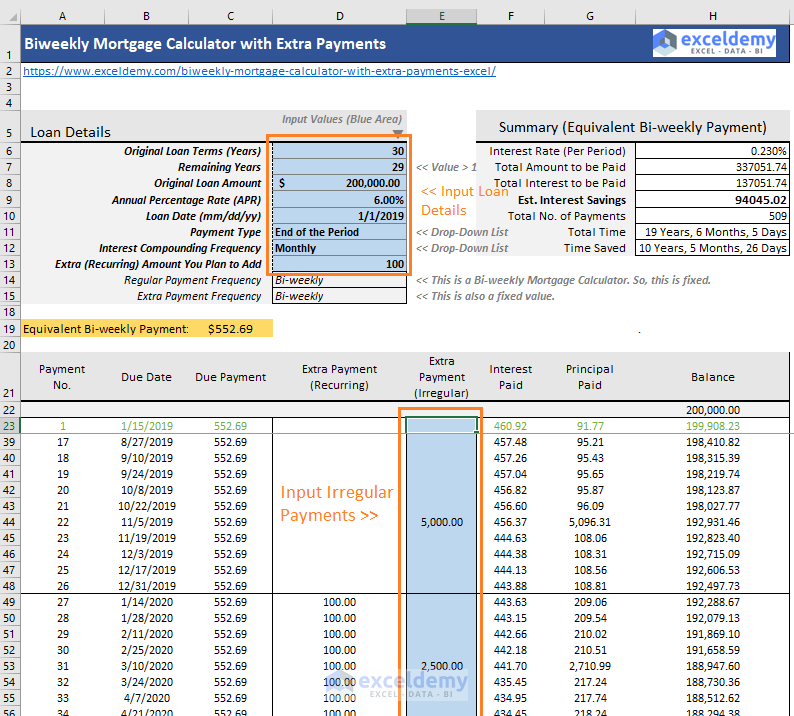

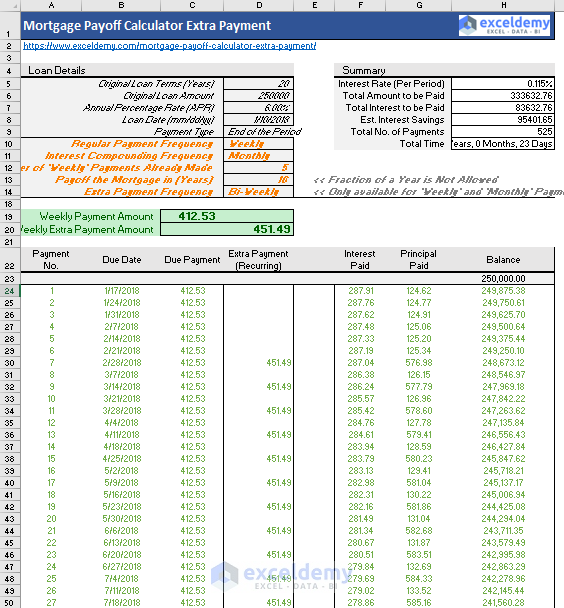

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator

Repayment Mortgage Calculator Clearance 55 Off Www Wtashows Com

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage With Extra Payments Calculator

Mortgage Calculator With Extra Payments Sale 53 Off Www Wtashows Com

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator With Extra Payments Store 55 Off Www Wtashows Com

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator For Extra Payments Cheap Sale 58 Off Www Wtashows Com

Mortgage Calculator With Extra Payments Clearance 53 Off Www Wtashows Com